529 compound interest calculator

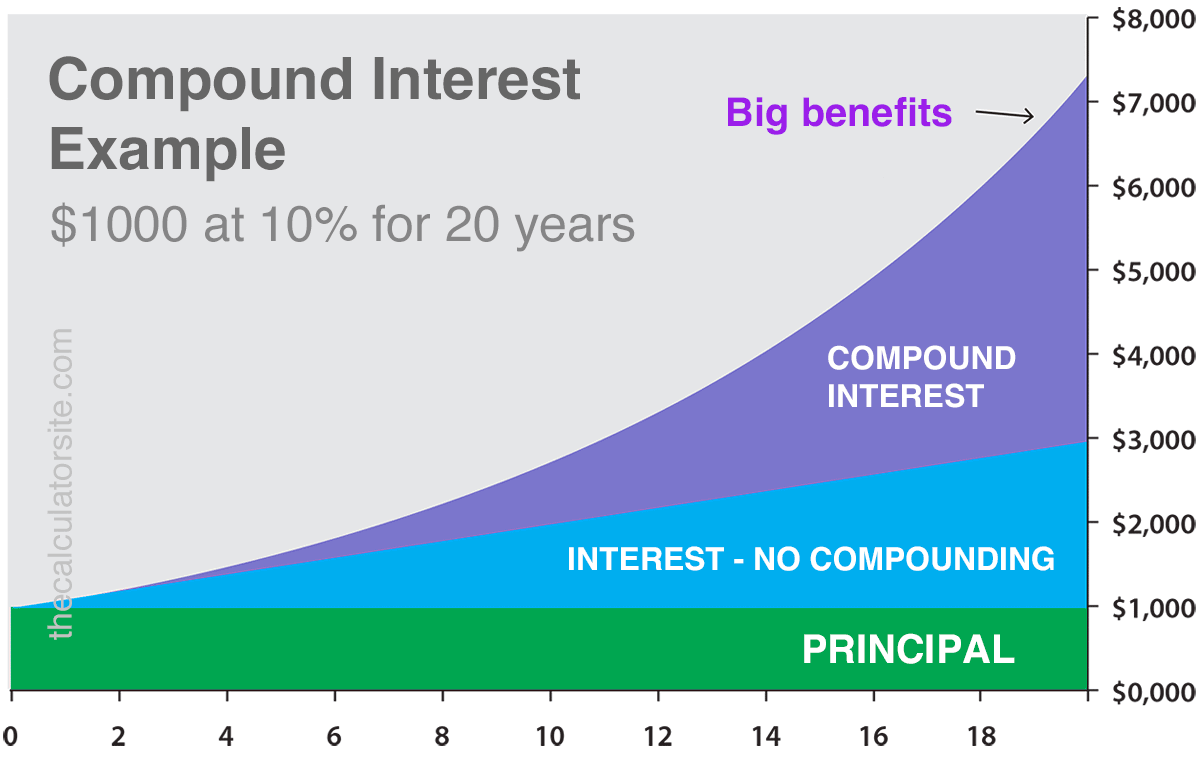

And like saving for retirement the earlier you start the plan the better. See how the tax deferral you get with a 529 savings plan can add up.

Compound Interest Calculator Daily Monthly Quarterly Annual

Retirement accounts such as a 401k 403b or Individual Retirement Account IRA.

. Calculate your 529 state tax deduction. With the Customized Age-Based Allocation and Fee Calculator or the Customized Static. Because these fees and expenses can vary widely from plan to plan the Financial.

Saving for a childs education requires a long-term plan. Initial balance or deposit Annual savings amount Annual. In the third year the new opening amount could be 11025 which could grow an additional 55125 assuming 5 interest.

Using this information with the 529 Savings Plan Calculator would result in an accumulated dollar amount of 26310. Compound Interest Calculator and Savings Goal Calculator. There are two distinct methods of accumulating interest categorized into simple interest or compound interest.

Learn the ABCs of 529 Education. The exact same figures being used in a. 529 Savings Plan Overview 529 State Tax Calculator Learning Quest 529 Plan.

Use this compound interest calculator to illustrate the impact of compound interest on the future value of an asset. My529s allocation and fee calculators help you build your own customized investment option. Calculate your earnings and more.

For more information about New Yorks 529 Advisor-Guided College Savings Program you may contact your financial advisor or obtain an Advisor-Guided Plan Disclosure Booklet and Tuition. For more information about CollegeBound 529 contact your. For more information about CollegeBound 529 contact your financial professional call 877-615-4116 or download the Program Description which includes investment objectives risks.

For the fourth year the starting amount in the. Use this college savings. See how your invested money can grow over time through the power of compound interest or use the savings goal.

Like most investments 529 education savings plans have fees and expenses that are paid by investors. 529 college savings plan. This investor bulletin covers the basics of 529 plans including the differences between prepaid tuition plans and education savings plans 9 min read.

Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. Use this compound interest calculator to illustrate the impact of compound interest on the future value of an asset. Compound Interest Calculator and Savings Goal Calculator.

The calculator uses compound interest calculations on future values and. And like saving for retirement.

Calculate How Much You Need For A College Savings Plan Bright Start

Saving Strategies Texas College Savings Plan

Can I Use A 529 Plan For K 12 Expenses Edchoice

How Much Should You Have In A 529 Plan By Age

Updated Compound Interest Calculator Future Value For Pc Mac Windows 11 10 8 7 Android Mod Download 2022

Compound Interest Investor Gov

Retirement For Beginners Part 2 Power Of Compound Interest

How Much Should You Have In A 529 Plan By Age

Compound Interest Calculator Daily Monthly Quarterly Annual

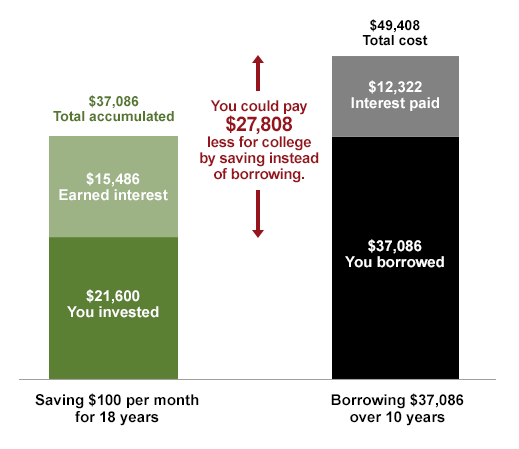

It S Not Easy To Save For College A My529 Account Can Help

Compound Interest Calculator Daily Monthly Quarterly Annual

Compound Interest Calculator

Answering Your Questions About Saving Early And Often With A 529 Plan Bright Start

Answering Your Questions About Saving Early And Often With A 529 Plan Bright Start

Let The Power Of Compound Interest Help Your 529 Plan Take Off

The Best 529 Plans Of 2022 Forbes Advisor

Saving More Now Borrow Less Later College Savings Iowa 529 Plan